change in net operating working capital formula

Operating working capital is defined as operating current assets less operating current liabilities. Given those figures we can calculate the net working capital NWC for Year 0 as 15mm.

Current Operating Assets 50mm AR 25mm Inventory 75mm.

. This metric is much more tied to cash flows than the net working. Changes in net working capital show. At the very top of the working capital schedule reference sales and cost of goods sold from the income statement for all relevant periods.

Just Now Step 4. Subtract the previous years working capital from the current years working capital according. You just need to minus the current years working capital from.

Related

- hotels in florence alabama with pool

- who owns primary care partners in lincoln ne

- hotels in moss point ms on hwy 63

- electric motors for sale in zimbabwe

- second chance apartments with move in specials san antonio tx

- dote shopping app not working

- Climate change

- stock market explained in spanish

- best places to live in alaska for families

Based on the above calculation the Net. The last step is to determine the change in working capital by using the formula. Deferred Revenue 5 million.

Accrued Expenses 20mm. Accrued Expenses 10 million. 2 days ago The formula for working capital is.

The formula for working capital is current operating assets minus current operating liabilities. The last step is to find the change in net working capital. How to calculate net working capital.

The following steps provide additional. The change in working capital formula is straightforward once you know your balance sheet. Question 1 11 Formula.

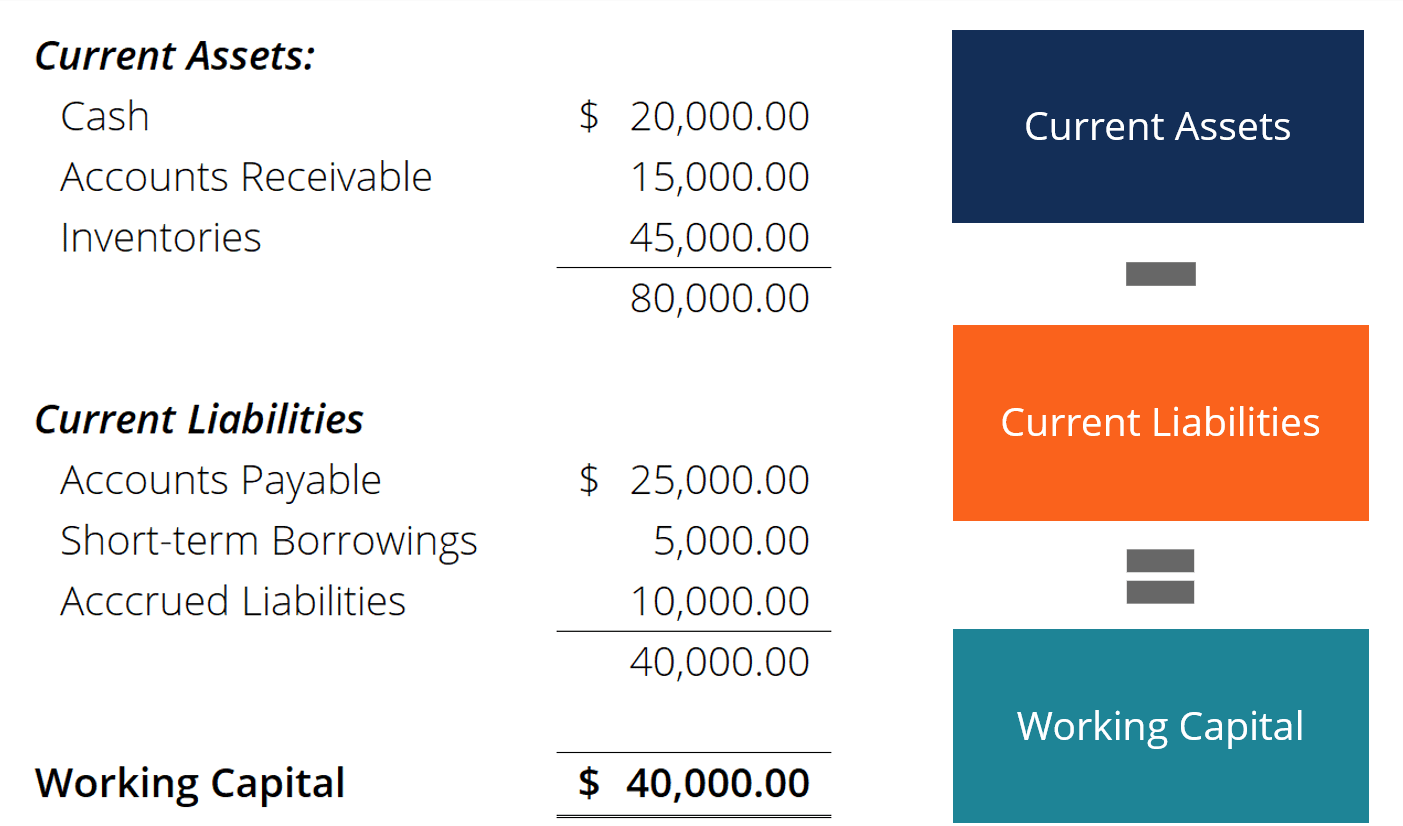

Total net operating capital represents all the current and non-currents assets used by a business in its operations. Cash flow from operating activities Net income Depreciation - Change in working capital - Interest dividends and taxes payments Depreciation 323200. Net Working Capital Total Current Assets Total Current Liabilities.

Thus the value of working capital in 2021 comes out to be -9972000000. The net working capital ratio formula is 600000 of current assets divided the 350000 of current liabilities for a working capital ratio of 171. In essence the NOWC is part of the TOC.

These will be used later to. It includes inventories accounts receivables fixed assets etc. May 20 2011 - 244pm.

What is the difference between net operating working capital and the total operating capital. Cash Accounts Receivable Inventory Accounts Payable Accrued Expenses This calculation is tied much. Simply take current assets and subtract current liabilities.

You can find net working capital by subtracting current liabilities from current assets. The formula for calculating net operating working capital is. Here you can see.

Change In Net Working Capital Formula with Ingredients and Nutrition Info cooking tips and meal ideas from top chefs around the world. The net operating working capital formula is calculated by subtracting working liabilities from working assets like this. Second seems like you may be referring to the CHANGE in working cap.

The formula for working capital is current operating assets minus current operating liabilities. To calculate total operating. Net working capital 7793 Cr.

Net working capital is the difference between a companys current assets. How To Calculate Change In Working Capital. Operating represents assets or liabilities which are used in the day-to-day.

By calculating the sum of each side the following values represent the two inputs required in the operating working capital. Net working capital 106072 98279. First Im assuming you know WC Current Assets - Current Liab.

The Term Operating Profit Means

Change In Net Working Capital Nwc Formula And Calculation Bookstime

Net Working Capital Formula Definition Formula How To Calculate

Working Capital Definition Formula Examples With Calculations

Calculate The Change In Working Capital And Free Cash Flow

𝟒 𝐄𝐚𝐬𝐲 𝐒𝐭𝐞𝐩𝐬 𝐟𝐨𝐫 𝐂𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐢𝐧𝐠 𝐂𝐡𝐚𝐧𝐠𝐞s 𝐢𝐧 𝐍𝐞𝐭 𝐖𝐨𝐫𝐤𝐢𝐧𝐠 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 Accounting Drive

Net Working Capital Guide Examples And Impact On Cash Flow

Changes In Net Working Capital Calculation With Example Youtube

How To Calculate Change In Working Capital Detailed Analysis Iifpia

Difference Between Net Income Vs Net Operating Income Approach

Changes In Net Working Capital Calculator Efinancemanagement

Working Capital Trend Analysis Report Example Uses

Days Working Capital Definition Calculation And Example

Change In Net Working Capital Formula Calculator Excel Template

From The Following Calculate Operating Profits Before Working Capital Changes Net Profit Before Tax And Extraording Items 2 23 500 Deprection 42 000 Interest On Borrowings 8 400 Goodwill Amortised 9 300 Loss

Working Capital Importance Policy Manage Finance Efm

Net Working Capital Formulas Examples And How To Improve It

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial