vermont department of taxes homestead declaration

Annually on or before the due date for filing the Vermont income tax return without extension each homestead owner shall declare his or her homestead as of April 1 of the year in which the declaration is made. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

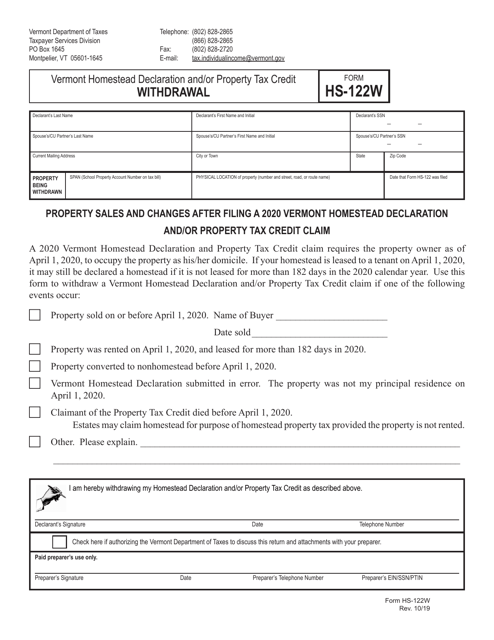

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

Filing the Homestead Declaration.

. She declares the property as her homestead. Once you have fulfilled the criteria you can apply for the exemption which will ensure that your state education tax rate is classified correctly. Start completing the fillable fields and carefully type in required information.

Box 1645 Montpelier VT 05601-1645. If your homestead is leased to a tenant on April 1 you may still claim it as a homestead if it is not leased for more than 182 days in the 2020 calendar. W-4VT Employees Withholding Allowance Certificate.

PA-1 Special Power of Attorney. Pay Estimated Income Tax Online. Pay Estimated Income Tax Online.

Use Get Form or simply click on the template preview to open it in the editor. Effective July 1 2022. This fact sheet will.

Homestead Declaration and Property Tax Adjustment. Vermont Department of Taxes PO. You may file with your annual Income Tax Return or on-line after January 1st using the Vermont Homestead Declaration form which can be accessed at the web link below.

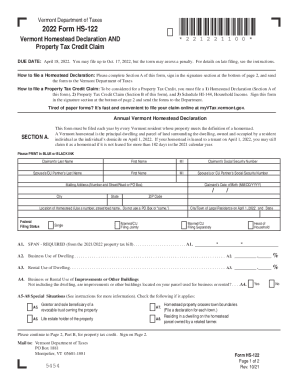

Lucinda is the Homeowner. Pay Estimated Income Tax by Voucher. Tax Year 2021 Instructions HS-122 HI-144 Vermont Homestead Declaration AND Property Tax Credit Claim.

Forms HS-122 and HI-144. James Grace and Lucinda jointly own a home and all live in the home. As long as the property meets the requirements of a Vermont homestead a part of the homestead property may be used for commercial purposes or as a rental.

Vermont Property Tax Adjustments. Those who are unable to meet the May 17 personal income tax filing deadline may file an application to extend to October 15 but taxpayers must still pay any tax owed by May 17. For more information on the Homestead Declaration and the Property Tax Adjustment Claim visit wwwtaxvermontgov or contact the Vermont Department of Taxes at 802 828-2865 or 866 828-2865 toll-free in Vermont.

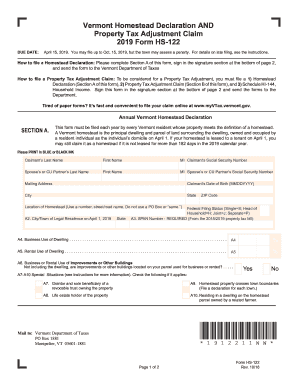

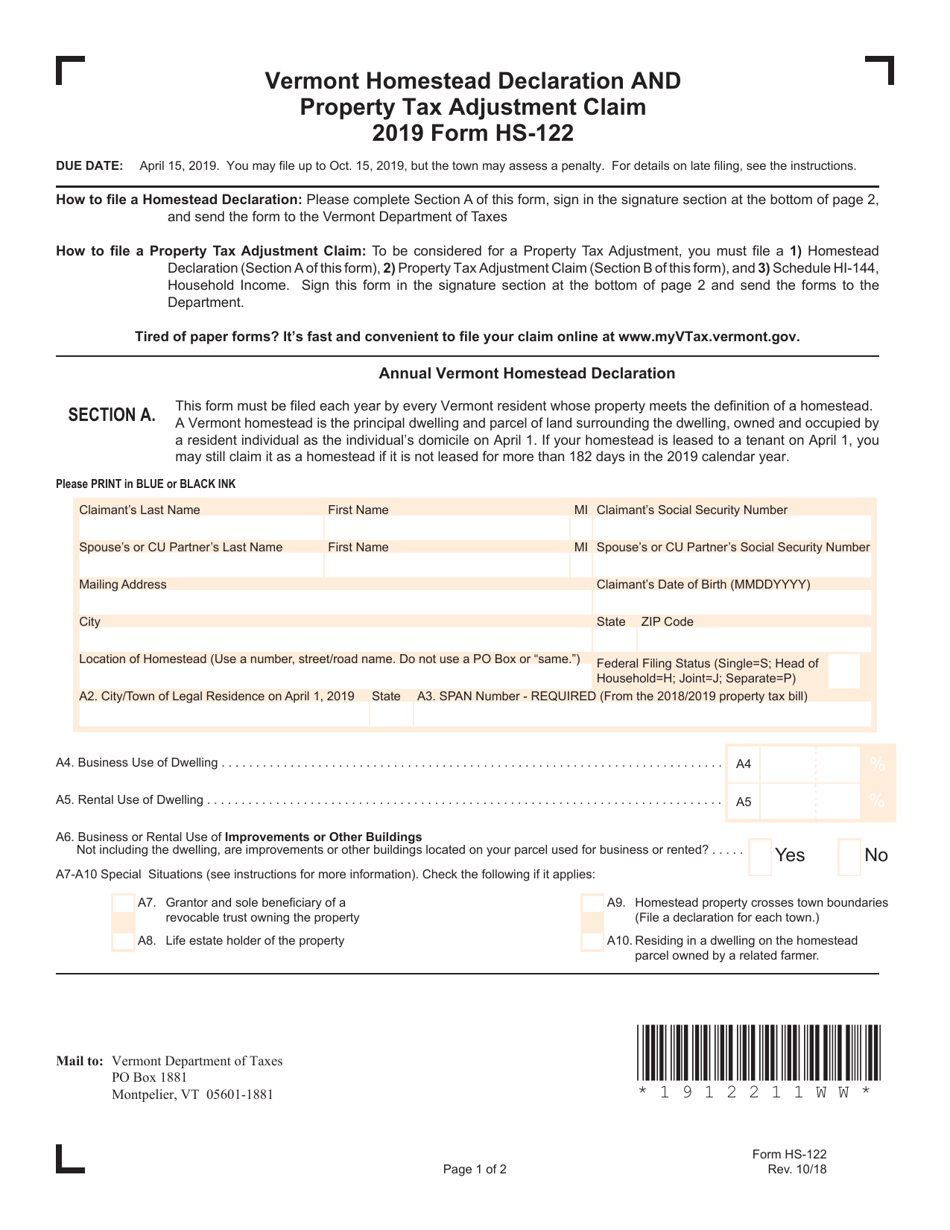

Please complete Section A of this form sign in the signature section at the bottom of page 2 and send the form to the Vermont Department of Taxes How to file a Property Tax Credit Claim. The different education tax rates are currently 168 per 100 of property value for non-homestead properties and 1 for homesteads. Both electronic filing and form HS-122 may be found online at the Department of Taxes website at wwwtaxvermontgov.

Malt and Vinous Tax. She enters the amount found on the property tax bill for the housesite value the housesite property taxes and enters 100 ownership interest as all owners live in the home. Mon 01242022 - 1200.

This set of forms is used to tell the state of Vermont that you live in the house you own homestead declaration and to ask for help paying your property taxes property tax. How to file a Homestead Declaration. The Vermont Property Tax Credit assists many.

The Vermont Homestead Declaration By Vermont law property owners whose homes meet the definition of a Vermont homestead must file a Homestead Declaration annually by the April due date. Many people file their Homestead Declarations at the same time they file their Vermont income tax returns. Homestead Declaration and Property Tax Adjustment Filing Vermontgov.

The Homestead Declaration is filed using Form HS-122 the Homestead Declaration and Property Tax Credit Claim or save time by filing your Homestead Declaration online. Send the amended HI-144 separately from any other returns being filed with the Department. Department of Taxes.

IN-111 Vermont Income Tax Return. Vermont Homestead Declaration Form HS-122 Section A The Homestead Declaration must be filed annually by every Vermont resident homeowner on their primary residence as of April 1 of the calendar year. However if any part of the dwelling is a rental then the.

Quick steps to complete and e-sign Vt homestead declaration online. Department of Taxes. PA-1 Special Power of Attorney.

If more than 25 of the dwelling is used for business purposes then that portion must be reported as nonhomestead on the Homestead Declaration. To be considered for a Property Tax Credit you must file a 1 Homestead Declaration Section A of this form 2 Property Tax Credit Claim. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

A Vermont homestead is taxed at the homestead education property tax rate while a different education property tax rate applies to non-homestead property. Increases annual renewal fee paid by investment companies from 1500 to 1650. Homestead means the principal dwelling and parcel of land surrounding the dwelling owned and occupied by a resident.

THE HOMESTEAD DECLARATION must be filed each year by Vermont residents for purposes of the state education tax rate. In order to maintain your Homestead tax rate status you must file your Homestead Declaration annually. Vermont Income Tax Return.

If you have additional questions please contact the Vermont Department of Taxes. VT Homestead Declaration and Property Tax Credit Claim. Tim and Dan own a home.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Use myVTax the departments online portal to e-file Form HS-122 Homestead Declaration and Property Tax Adjustment Claim and Schedule HI-144 Household Income with the Department of Taxes. The Declaration identifies the property as the homestead of the Vermont resident.

Pay Estimated Income Tax by Voucher. 12 of Act 138 changes the annual renewal fee paid by investment companies doing business in Vermont. Tax reductions and other aid for Vermonters Act 138 H510 Sec.

Mail your return to. Taxpayers are encouraged to file all documents electronically using tax software a tax preparer or the departments taxpayer portal at myVTaxvermontgov. If eligible you must file so that you are correctly assessed the homestead tax rate on your property.

This will reduce that portion of your total property tax bill.

Vt Dept Of Taxes Vtdepttaxes Twitter

Hs122 Fill Out And Sign Printable Pdf Template Signnow

Vermont Tax Forms And Instructions For 2021 Form In 111

Download Instructions For Form Hs 122 Vermont Homestead Declaration And Property Tax Credit Pdf 2020 Templateroller

Welcome To South Burlington Vermont

Vt Form Hs 122 Download Fillable Pdf Or Fill Online Vermont Homestead Declaration And Property Tax Adjustment Claim 2019 Vermont Templateroller

National Homeownership Month Infographic Home Ownership Fort Lauderdale Real Estate Florida Real Estate

Declaring Your Vermont Homestead Most Situations The Basics Youtube

What To Know About Vermont S Property Transfer Tax Vhfa Org Vermont Housing Finance Agency

How To File And Pay Sales Tax In Vermont Taxvalet

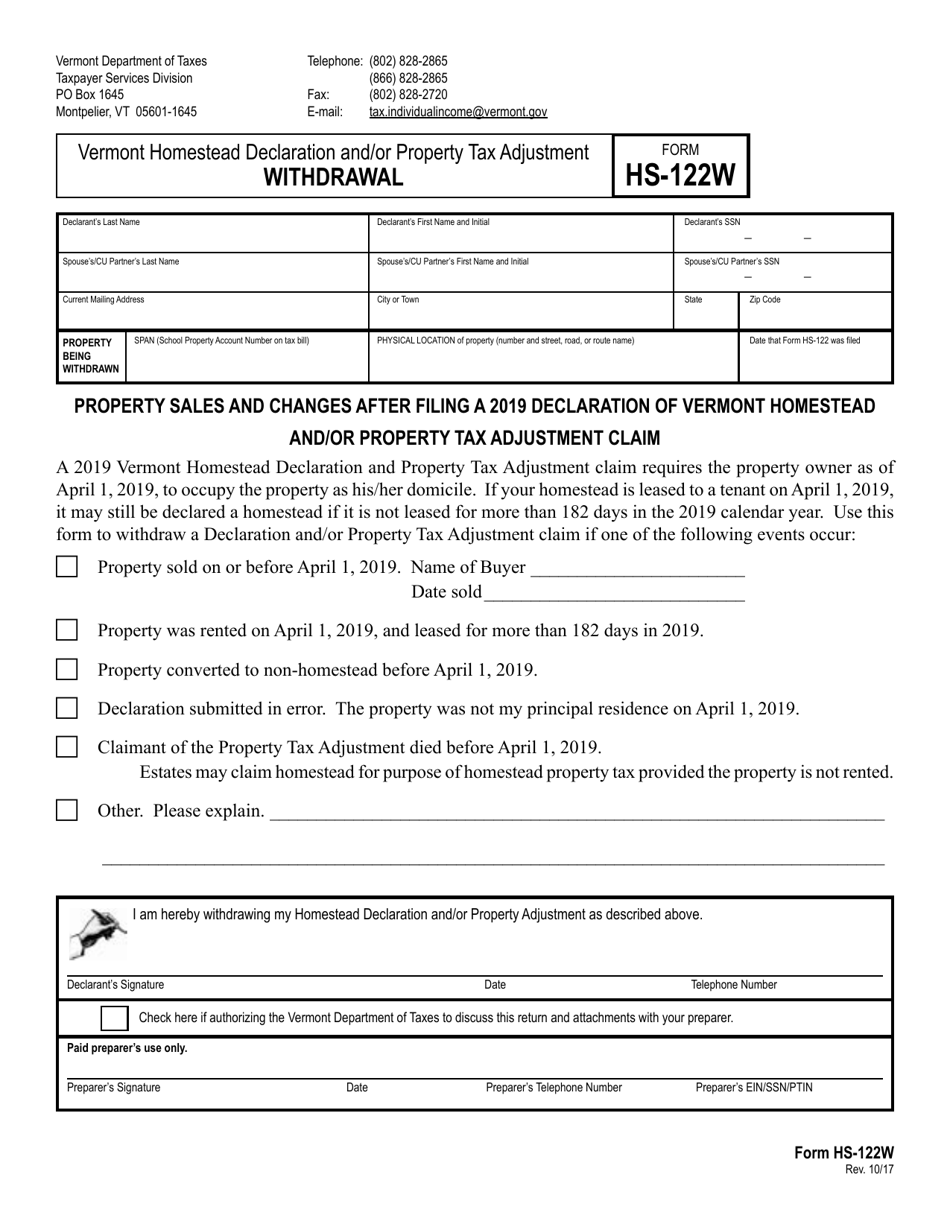

Vt Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Adjustment Withdrawal Vermont Templateroller

Homestead Declaration Vermont Department Of Taxes Fill Out And Sign Printable Pdf Template Signnow

Publications Department Of Taxes

Vermont Department Of Taxes Youtube

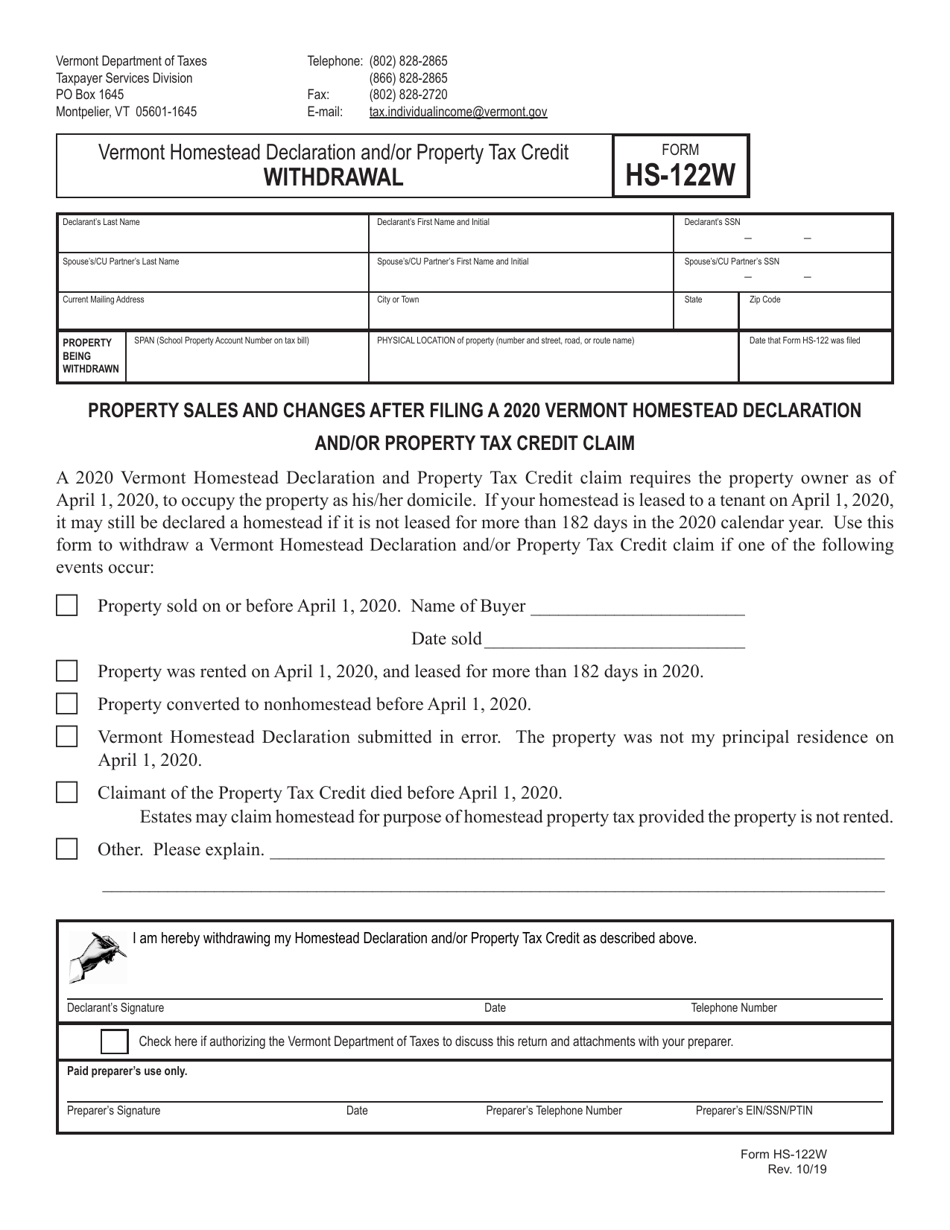

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

Filing A Vermont Income Tax Return Things To Know Credit Karma